Property Market

Property Market

08 Jan 2026

UK Property Market 2025 vs 2024, A More Local Story Than Ever

This comparison of UK homes, spilt down by regoinsold s…

Property Market

As the property landscape in Chelmsford continues to evolve, many homeowners who have been on the market for a while find themselves navigating the complex decision of when and how much to reduce their asking prices to attract buyers.

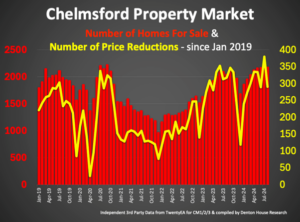

With an increasing number of properties on the market in the Chelmsford area, rising from 1,376 in August 2022 to 2,168 in August 2024, the competition is becoming fiercer, making strategic price adjustments more crucial than ever.

(Chelmsford CM1/2/3)

Understanding and utilising price bands on the portals (Rightmove, Zoopla and OnTheMarket) can significantly enhance the visibility of your property listing. These bands are predefined price ranges that buyers often use to filter their search results. Positioning your property’s asking price in one of these bands will strategically draw more views, and thus more interest, viewings and ultimately increase the chances of achieving a sale. For instance, pricing a property on a significant threshold, such as setting an asking price at £300,000 instead of £299,950, places the property in a search of £280,000 to £300,000 and £300,000 to £325,000, potentially attracting a broader audience.

A critical factor in the timing of price reductions is their impact on buyer visibility. Homeowners need to reduce their asking price by at least 2% to ensure their property reappears in Rightmove and OnTheMarket’s email alerts, while for Zoopla it is 3%, capturing the attention of active buyers.

Several Chelmsford home movers have said to me recently that they believe there are a greater number of price reductions happening at the moment, compared to a couple of years ago.

As I explained in the initial part of the article, the number of properties for sale has substantially grown in the last couple of years in the Chelmsford area. If there are a greater number of properties for sale, I would expect a great number of price reductions.

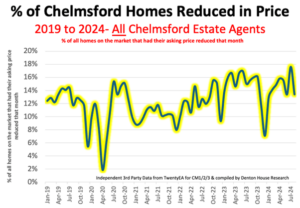

So, the statistics for the Chelmsford area reveal that while the number of properties for sale is on the rise, the number of reductions has increased. In fact, the percentage of Chelmsford properties undergoing price reductions has remained roughly consistent in recent years, with an average of 1 in 8.1 Chelmsford homes (12.3%) reducing their asking price each month over the last five and a half years.

This trend underscores the importance of setting a realistic price from the outset to stand out in a crowded market.

The initial pricing strategy plays a pivotal role in the speed and success of your property sale. Chelmsford properties priced too high at the onset tend to linger on the market, eventually requiring more significant reductions to generate interest. In contrast, Chelmsford homes priced realistically from the beginning are more likely to attract offers quickly, reducing the need for substantial price cuts.

For Chelmsford homeowners considering a higher initial asking price, it’s advisable to be prepared to make an adjustment swiftly. A reduction within the first 2 to 4 weeks can prevent your property from stagnating on the market, whereas waiting 2 to 4 months might diminish your chances of securing a prompt sale.

Given the complexities of the Chelmsford property market, seeking a second opinion from an expert such as ourselves can provide you with insights tailored to your specific situation. It’s essential to choose a consultant who will offer honest advice, possibly telling you what you need to hear rather than what you want to hear.

Are you currently on the market in Chelmsford and contemplating a price reduction? Or perhaps you’re seeking to list your property soon? For a no-obligation consultation and a fresh perspective on your property strategy, feel free to contact me. Together, we can ensure that your home is positioned effectively to attract buyers and achieve a successful sale.

Lets get started! Our valuations are based on our extensive knowledge of the whole of the market.

Get a valuation